Colton Bankruptcy Attorney

Colton residents and businesses with overwhelming debt can seek the services of a Colton bankruptcy attorney. While bankruptcy is not for everyone and is not meant to be the ultimate solution for financial difficulties, it can be a means to get you or your business back on track.

A Colton bankruptcy attorney can assess your situation, needs and goals and counsel you on how bankruptcy could help. Chapter 7 is a liquidation of unsecured debt such as credit cards and medical expenses. A Chapter 13 could allow some Colton homeowners to get out of foreclosure or others to ward off a vehicle repossession. A Colton bankruptcy attorney who handles Chapter 11 can discuss the complexities and intricacies of a reorganization plan for a corporation or other business.

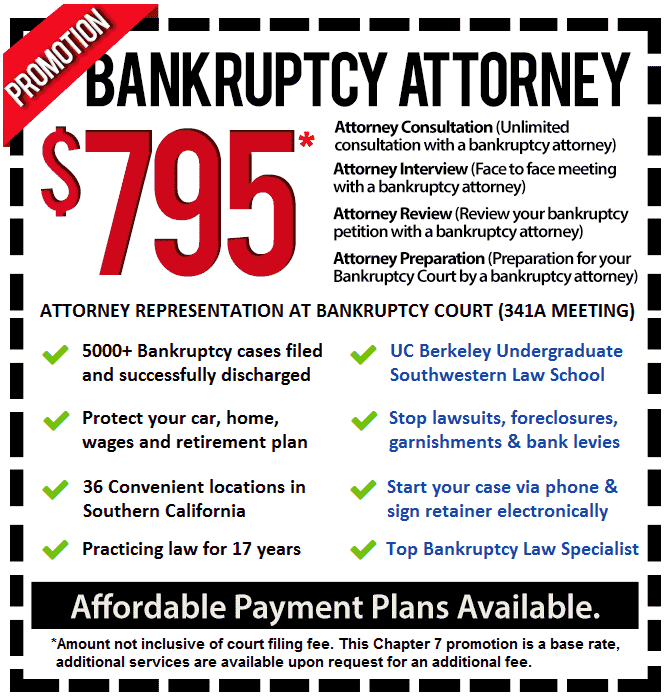

In most cases, you can retain most if not all of your hard-earned possessions and assets. Contact a Colton bankruptcy attorney today at 909-254-4139 to discuss the various options and what your obligations will be when filing.

A Colton bankruptcy attorney can handle any of the three common types of bankruptcy filings: Chapter 7, Chapter 13 and Chapter 11.

Chapter 7 Bankruptcy

Chapter 7 is designed to allow Colton residents with primarily consumer debt to have those debts discharged. A Chapter 7 bankruptcy lawyer will advise you that you must first qualify by passing a means test that measures your income against the state median for your household size. If your income is too high, a Chapter 7 bankruptcy lawyer can still qualify you if your  disposable income is not above a certain amount. Most Colton residents will be eligible.

disposable income is not above a certain amount. Most Colton residents will be eligible.

Your Chapter 7 bankruptcy lawyer will have you take a brief debt education class before your petition is prepared. All debts and assets are listed and your Chapter 7 bankruptcy lawyer will use a list of exemptions to ensure that most if not all of your assets are retained. Once you file, all collection activities including phone calls and seizure of assets must cease.

You and the Chapter 7 bankruptcy lawyer will usually attend just one meeting with the trustee who will review your petition. You will have to take an additional short class on financial management before your discharge, generally 4-months after filing. Talk to a Colton bankruptcy lawyer about how to be relieved of overwhelming debt.

Chapter 13 Bankruptcy

Should a Colton debtor not qualify for Chapter 7 or have valuable non-exempt assets, a Chapter 13 bankruptcy attorney can advise you on filing under Chapter 13, a wage earner’s plan that requires you to have a reliable source of income. Your Chapter 13 bankruptcy attorney will prepare a payment plan that repays creditors and can save your home from foreclosure or car from being repossessed by making up the arrearages over a 3 or 5 year plan. You do have to keep your payments current. Creditors in order of priority are paid first over the life of the plan, but any unsecured debt left over is discharged.

Your Chapter 13 bankruptcy attorney can also help small businesses wishing to continue operating. Your creditors are paid back over the term of the plan.

All debtors submit one monthly payment to the trustee for distribution. If you have an emergency that makes it difficult to make the payment, your Chapter 13 bankruptcy attorney can seek to have it modified. Consult with a Colton bankruptcy lawyer to see if a Chapter 13 can help.

Chapter 11 Bankruptcy

Corporations and other businesses may use Chapter 11. This is a complicated and drawn-out process in many cases that can enable struggling businesses to revise their business plan and goals in a restructuring or reorganization. Creditors can also force businesses into involuntary bankruptcy in some cases.

An experienced Chapter 11 bankruptcy attorney drafts a reorganization plan that shows how your Colton Corporation or other business can ultimately return to profitability. In large cases, one or more creditors’ committees are formed that must approve the plan, though they can submit competing plans of their own for approval.

Once approved, the business officers or directors can have existing leases and other contracts re-negotiated and new funding sources reviewed. Often the business is streamlined or even bought out or merged with a viable company.

Small businesses can be fast-tracked so as to bypass many of the filings and other formalities that can speed the process at much less cost. Talk to a Chapter 11 bankruptcy attorney about this process.

Talk to a Colton Bankruptcy lawyer at 909-341-2588 about these various types of bankruptcy. A Colton bankruptcy lawyer is ready today to consult with you and get you back to the path of success.